Start Your Journey...

| |

Do you maintain a minimum balance of $1,000 in your account?

Premier Checking

|

Do you use your cell phone to look for local deals while shopping?

Advantage Checking

|

Do you want a low cost account with basic benefits?

Freedom Checking

|

|---|

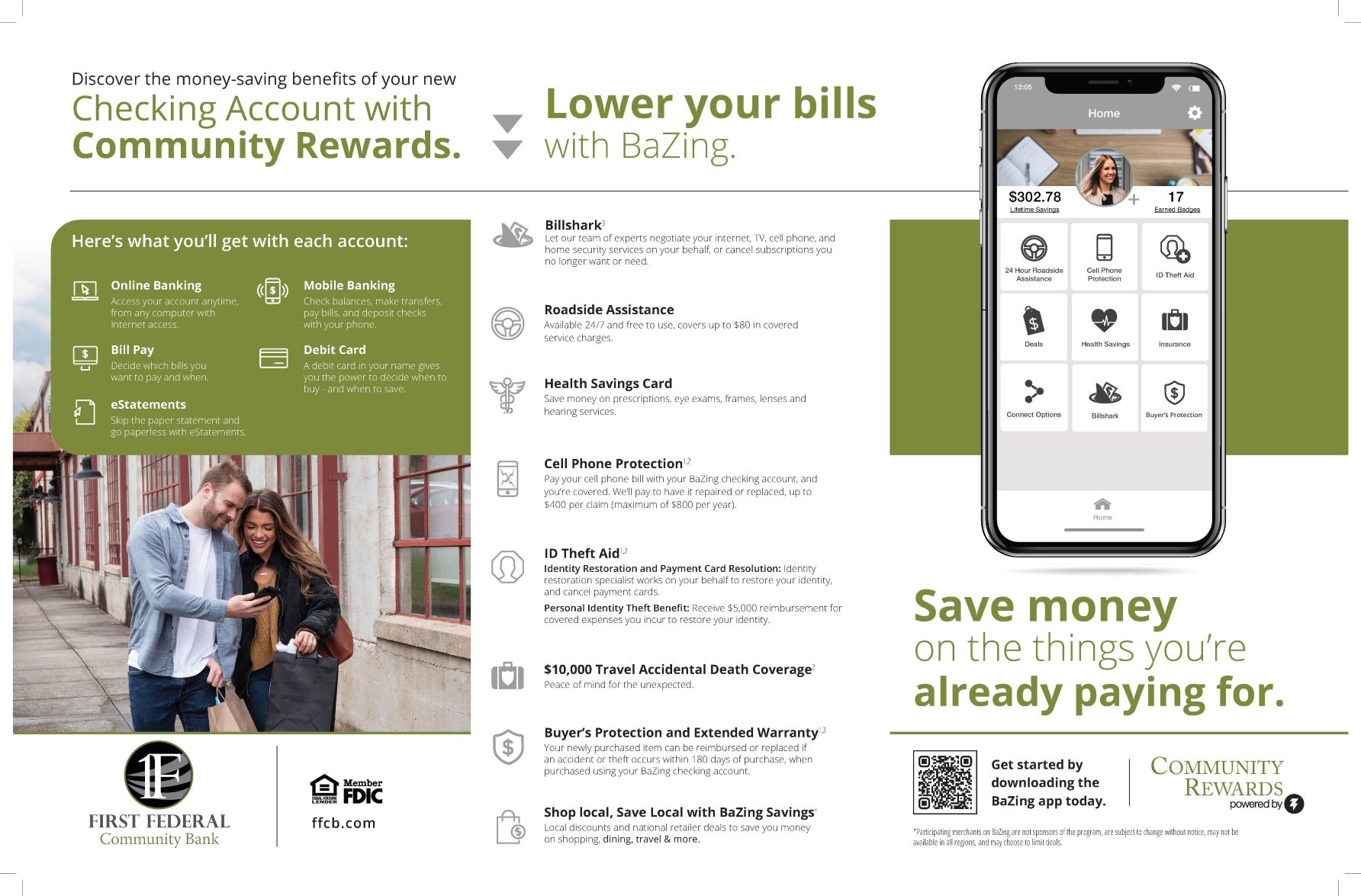

Anywhere Banking Tools

Online banking, mobile banking, pill pay, debit card and eStatement.

|

Ο |

Ο |

Ο |

eStatements

eStatements available for free on all accounts. Paper statement fee of $3 per month applies to all accounts.

|

Ο |

Ο |

Ο |

Billshark3

Let our team of experts negotiate your internet, TV, cell phone, and home security services on your behalf, or cancel subscriptions you no longer want or need.

|

Ο |

Ο |

|

Buyer's Protection and Extended Warranty1,2

Items are protected for up to $2,500 per item if theft or accidental breakage occurs during the first 180 days of purchase, using your BaZning checking account.

|

Ο |

Ο |

|

ID Theft Aid1,2

Includes identity restoration and payment card resolution and $5,000 in personal identity theft benefits.

|

Ο |

Ο |

|

Roadside Assistance

Available 24/7 and free to use, up to $80 in covered service charges.

|

Ο |

Ο |

|

Health Savings Card

Save money on prescriptions, eye exams, frames, lenses, and hearing services.

|

Ο |

Ο |

|

Cell Phone Protection1,2

Receive up to $400 per claim ($800 per year) if your cell phone is broken or stolen.

|

Ο |

Ο |

|

Shop Local, Save Local with BaZing Savings

Local discounts and national retailer deals to save you money on shopping, dining, travel, & more.

|

Ο |

Ο |

|

$10,000 Travel Accidental Death Coverage2

Peace of mind for the unexpected.

|

Ο |

Ο |

|

Great Interest on Your Checking Balance

Our best checking rate.

|

Ο |

|

|

|

Additional Information

|

$10 per month or waived by maintaining a minimum monthly balance of $1,000. |

$7 per month. |

Free with eStatements |

1 Subject to the terms and conditions detailed in the Guide to Benefits.

2 Insurance products are NOT A DEPOSIT, NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY.

3 Billshark requires additional activation to begin.

Rewards

|

|

|